By Peter M. Carrozzo, Chief Counsel Cornerstone Land Abstract

When you attempt to sell your home, the existence of an old mortgage on a property often leads to additional red tape. Documents that can remove open mortgages, such as satisfactions, could be misplaced or hard to obtain in general. Below is a look at some of the scenarios one might face in trying to resolve an “ancient” mortgage clouding title and the ways title companies can assist in that process.

The existence of an old mortgage on a property we are attempting to insure is a very common issue we ace at Cornerstone Land Abstract. Sometimes the mortgage is against a prior owner. Usually in those scenarios, the mortgage was “paid off” after closing (this is the responsibility of the title company at the closing when the current owner purchased). However, the satisfaction of mortgage was never sent by the bank to the county for recording, was rejected by the county for some error on the satisfaction itself and subsequently lost in transit, was misplaced by the county or was sent to the original borrower and lost.

Sometimes the mortgage is against the current owner. Usually in this scenario, the owner mortgaged the property at the time of purchase (i.e. a purchase money mortgage) and paid it off but never received a satisfaction of mortgage or received the satisfaction and either lost or destroyed it. A letter usually accompanies the satisfaction congratulating the borrower on paying off their mortgage and advising them to record the satisfaction, but the recipient does not realize they are responsible to have it recorded or does not know how to go about doing so.

“Even if you can determine the identity of the last lender to hold your mortgage, the record of your mortgage may be lost among the transfers.”

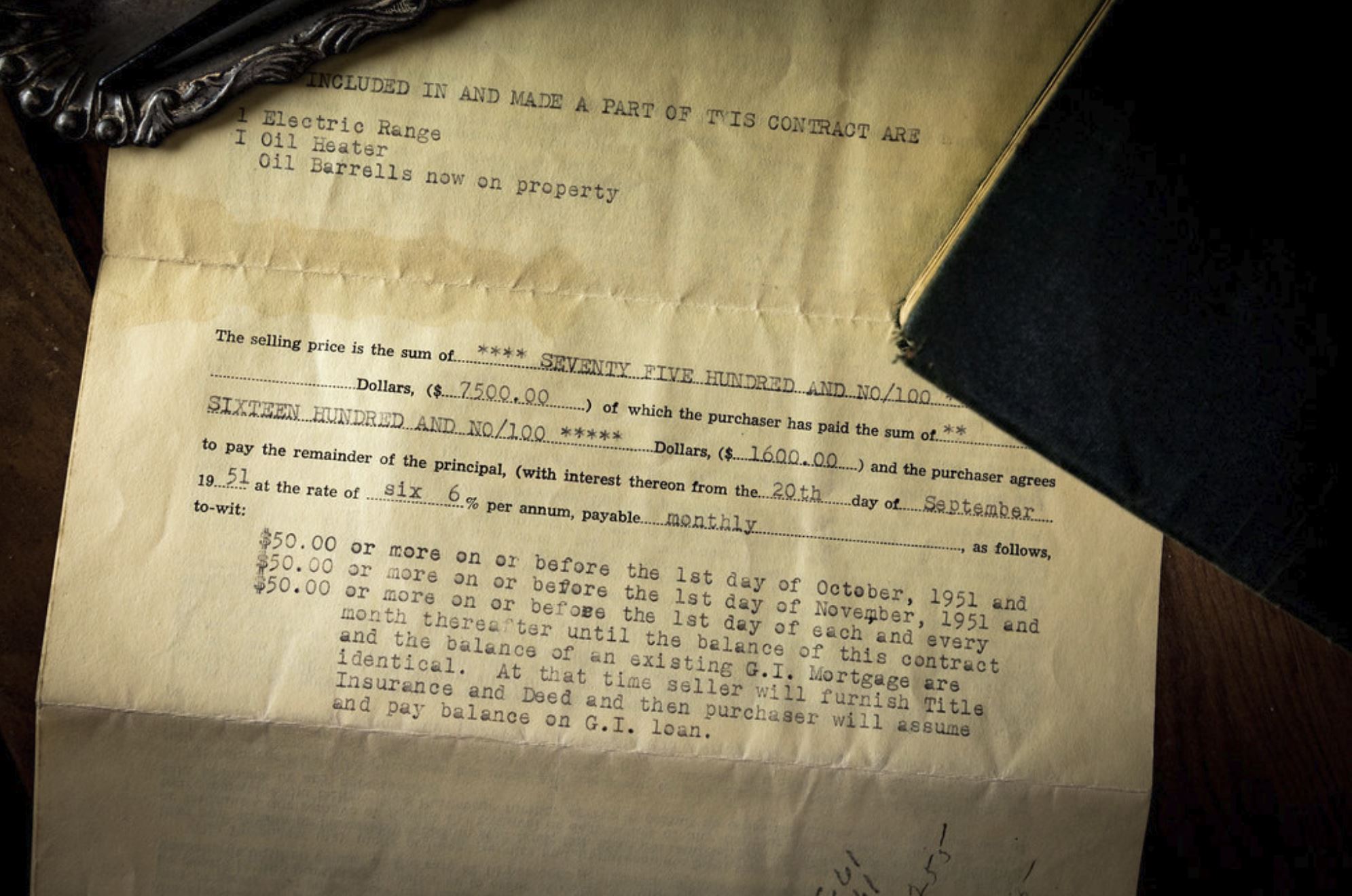

I have seen this in countless scenarios. Often, a musty satisfaction, yellow in appearance and fresh from a decades-long stay in a safety deposit box or file cabinet, will appear at closing and, provided it is an original document, allow the title company to omit (i.e. clear) the mortgage. Homeowners who engage in the old tradition of holding a mortgage burning party (a common event depicted in an episode of “All in the Family”) might inadvertently burn the satisfaction sent with the mortgage. This mistake will come back to haunt the homeowner.

Under Real Property and Procedures Act (RPAPL) Section 1921 (1) after full payment of principal and interest, upon request, a lender must execute a satisfaction of mortgage and have it recorded within thirty days. Lenders are subject to penalties paid to the borrower in the event they do not comply as follows: $500.00 if not received within thirty days, $1,000.00 if not received within sixty days, and $1,500.00 if not received within ninety days. Thus, a borrower can contact the lender and request a duplicate original satisfaction. However, since banks merge, fail, go into receivership and are subsumed by other banks, finding your lender is not always so simple. Even if you can determine the identity of the last lender to hold your mortgage, the record of your mortgage may be lost among the transfers. Banks have entire research departments dedicated to finding mortgages. The older the origination date of your mortgage, the more difficult it is for research departments to locate it and confirm that it has been satisfied. Where does that leave a homeowner with an old unsatisfied mortgage encumbering title to their home?

Tune in next month for the second part of our discussion. In the meanwhile, Let Cornerstone Land Abstract assist you if you are facing this challenge. If you have any questions about a mortgage on your property, please contact one of our clearance counsels for a free consultation at: (212) 840-0071 or info@cltitle.com.